I’ll never forget the panic I felt sophomore year when I checked my meal plan balance in March and realized I had $47 left for the rest of the semester. Standing in the Student Union with my stomach growling, I had this moment where I thought, “How did I mess this up so badly?” Little did I know that figuring out my meal plan would actually teach me more about money than any finance class ever could.

SDSU Dining has been providing quality food service for residence hall students at SDSU since the first hall opened in 1959. After more than 60 years of operation, the system has evolved into a complex financial ecosystem that shapes student behavior in ways that extend far beyond simple nutrition.

Your SDSU meal plan balance isn’t just about buying food – it’s actually training your brain for lifelong financial decisions that will impact your career, relationships, and personal wealth for decades to come. I discovered this the hard way during my four years navigating campus dining, and what I learned fundamentally changed how I approach money management today.

Table of Contents

- The Psychology Behind Your Spending Habits on Campus

- How Campus Dining Apps Are Designed to Make You Spend More

- The Real Connection Between Food Choices and Your Future Health

- Why Your Meal Plan Balance Affects Your Social Life More Than You Think

- What Campus Dining Taught Me About Managing Money After Graduation

- The Hidden Politics of University Food Services

- How to Turn Your Meal Plan Experience Into Career Skills

TL;DR

- Your SDSU meal plan balance isn’t just about food – it’s training your brain for lifelong financial decisions

- Campus dining apps use sneaky tricks to encourage overspending through confusing interfaces and hidden balance information

- The convenience foods you’re eating now create hidden health costs that’ll hit your wallet years later

- Students with higher meal plan balances often become “social sponsors,” affecting both friendships and financial planning

- Meal plan management teaches subscription economics, budgeting under constraints, and resource allocation – skills you’ll need after graduation

- Universities collect extensive data on your dining patterns to optimize pricing and maximize revenue

- Food insecurity can exist even with meal plans due to poor balance management and social barriers

- The mindset you develop around meal plan scarcity or abundance influences decades of future financial behavior

The Psychology Behind Your Spending Habits on Campus

Look, I’m going to be real with you – managing your SDSU meal plan isn’t just about tracking how much money you have left. It’s actually rewiring your brain for how you’ll handle money for the rest of your life. And honestly? Most of us have no clue this is even happening.

I spent my entire freshman year swiping my card like it was some magical money tree. Grab a sandwich here, a fancy coffee there, maybe some overpriced snacks because why not? Then I’d check my balance and wonder where the hell all my money went. Sound familiar?

The thing is, your SDSU meal plan is basically training your brain to think about money in ways that’ll either help you or totally screw you over later. And most students never realize they’re in this psychological boot camp.

Why Your Brain Treats Meal Plan Money Like Monopoly Money

Here’s what’s happening: when you swipe your student ID instead of handing over actual cash, your brain literally processes it differently. It’s like the difference between losing $20 in real bills versus losing $20 in a video game – one hurts, the other doesn’t.

This “fake money” feeling leads to some pretty stupid decisions. You’ll buy the $15 sushi without thinking twice, but you’d never spend $15 cash on the same meal. According to SDSU Dining, meal plans work at over 35 locations on campus, which means there are 35 different places where your brain can trick you into overspending.

The Monopoly Money Effect Is Real (And Expensive)

I learned this the hard way when I started tracking what I was actually spending per meal. I divided my total meal plan cost by how many meals I should be eating, and it was a wake-up call. I was paying $12 for meals I could get off-campus for $6, just because it didn’t “feel” like real money.

Here’s what helped me: I started setting “cash equivalent” reminders on my phone. Before buying anything, I’d ask myself, “Would I pay this much if I had to hand over actual cash?” Most of the time, the answer was no.

End-of-Semester Panic Buying Makes No Sense (But We All Do It)

We’ve all seen it – that kid buying 47 energy drinks in the last week of spring semester because “I already paid for it!” That’s your brain falling for something called the sunk cost fallacy, which is basically feeling like you have to spend money just because you already spent money.

I watched my friend Marcus spend $300 in four days at the end of spring semester, buying cases of Red Bull and fancy grab-and-go meals. Meanwhile, I had figured out my weekly “burn rate” should be around $85 to use my balance properly throughout the semester.

SDSU doesn’t make this easy – there are no refunds on unused balances, and whatever you don’t use just disappears. It’s designed to create that panic.

Pro tip: Calculate your weekly spending target by week 4 of the semester. Set alerts when you hit 75%, 50%, and 25% of your balance. This way, you can actually enjoy premium options when they make sense, instead of panic-buying garbage at the end.

How Your Meal Plan Affects Your Social Life

This is where things get weird. Your meal plan balance basically becomes social currency. I’m talking about who pays for group meals, whether you can afford to eat where your friends want to go, and that awkward moment when everyone’s ordering expensive stuff and you’re calculating if you can afford it.

If you’ve got a higher balance, you might find yourself becoming the group’s unofficial meal sponsor. If your balance is low, you might start avoiding social meals altogether. Neither situation is great for your friendships or your wallet.

When You Become Everyone’s Meal Plan Sugar Daddy

This happened to me junior year. I had the bigger meal plan, and somehow I became the guy who always “treated” everyone. It started innocently – buying my girlfriend lunch here, covering a friend’s coffee there. But before I knew it, I was spending more on other people’s food than my own.

I had to learn to set boundaries, which was uncomfortable but necessary. I started suggesting non-food social activities and created a separate “social dining budget” so I could still treat people occasionally without going broke.

Premium Dining as Status Symbol

Let’s be honest – eating at the fancy campus restaurants becomes a weird status thing. You feel pressure to eat at the trendy spots to fit in, even when you’d rather just grab a simple sandwich.

I spent a month tracking why I chose certain dining spots, and it was embarrassing how often it was about image rather than actually wanting the food. Once I realized this, I started practicing what I called “stealth frugality” – finding satisfaction in simpler options without feeling like I was missing out.

The Daily Aztec reported on this exact pressure. As “The Daily Aztec” reports, journalism freshman Megan Oytas on the Flex 7 plan explained: “I feel bad when I have over one dollar left, I feel like I have to go out and spend all of it, because that’s my money basically, and that would be wasted the next day.” That daily pressure to spend creates all kinds of artificial social situations.

Here’s how the different SDSU dining system’s structure creates different levels of social pressure:

| SDSU Meal Plan Type | Daily Allowance | Weekend Coverage | Social Pressure Level |

|---|---|---|---|

| Flex 5 | $25.52 weekdays | None | High (no weekend funds) |

| Flex 7 | $25.52 weekdays | $15.25 weekends | Medium (limited weekend) |

| Meals Plus | $1,786.50 declining | Full semester | Low (flexible spending) |

| 2nd Year Plan | Varies | Full semester | Low (flexible spending) |

How Campus Dining Apps Are Designed to Make You Spend More

Okay, this is where I’m going to blow your mind a little. The app you use to check your meal plan balance? It’s not designed to help you save money. It’s designed to help you spend money. And once you see these tricks, you can’t unsee them.

I spent way too much time analyzing the SDSU dining app (my roommates thought I was losing it), but what I found was pretty eye-opening. These apps use the same psychological tricks that casinos and social media companies use to keep you engaged and spending.

The Sneaky Psychology Built Into Your Dining App

The app makes certain choices feel “natural” while others require extra work. Want to see your remaining balance? That might take three taps. Want to see the most expensive menu items? They’re right there on the home screen.

This isn’t an accident. Every button, every screen, every default setting is carefully designed to nudge you toward spending more money.

Dark Patterns That Cost You Money

Here are some tricks I noticed in campus dining apps:

- Your balance is often hidden or hard to find

- Expensive options are set as defaults

- It’s difficult to compare prices between locations

- Premium items are featured prominently

- Cheaper alternatives are buried in menus

I started tracking my spending outside the official app and requesting detailed monthly reports from dining services. The data they weren’t showing me clearly was pretty revealing.

Your Data Is Worth More Than You Think

Universities collect insane amounts of data about your eating habits. They know when you eat, where you eat, what you buy, and how much you spend. They use this information to design meal plans that extract maximum revenue while appearing student-friendly.

You can actually request your personal dining data under FERPA guidelines. When I got mine, it was fascinating and a little creepy. They knew my eating patterns better than I did.

The Real Cost of Convenience

Here’s something nobody talks about: the time cost of using your meal plan. You’re not just paying for food – you’re paying for the “convenience” of not having to think about meals. But is it actually convenient?

Time vs. Money Trade-offs You’re Not Calculating

I timed myself for a week getting lunch from the Student Union. Average time: 22 minutes (10 minutes walking there, 8 minutes in line, 4 minutes walking back). At $12 per meal, I was essentially paying $32.73 per hour for “convenience.”

Compare that to the 5-minute walk to an off-campus spot that cost $8, and suddenly the convenience premium didn’t seem worth it for every meal.

The key is figuring out when convenience is actually worth the cost versus when you’re just being lazy and paying extra for it.

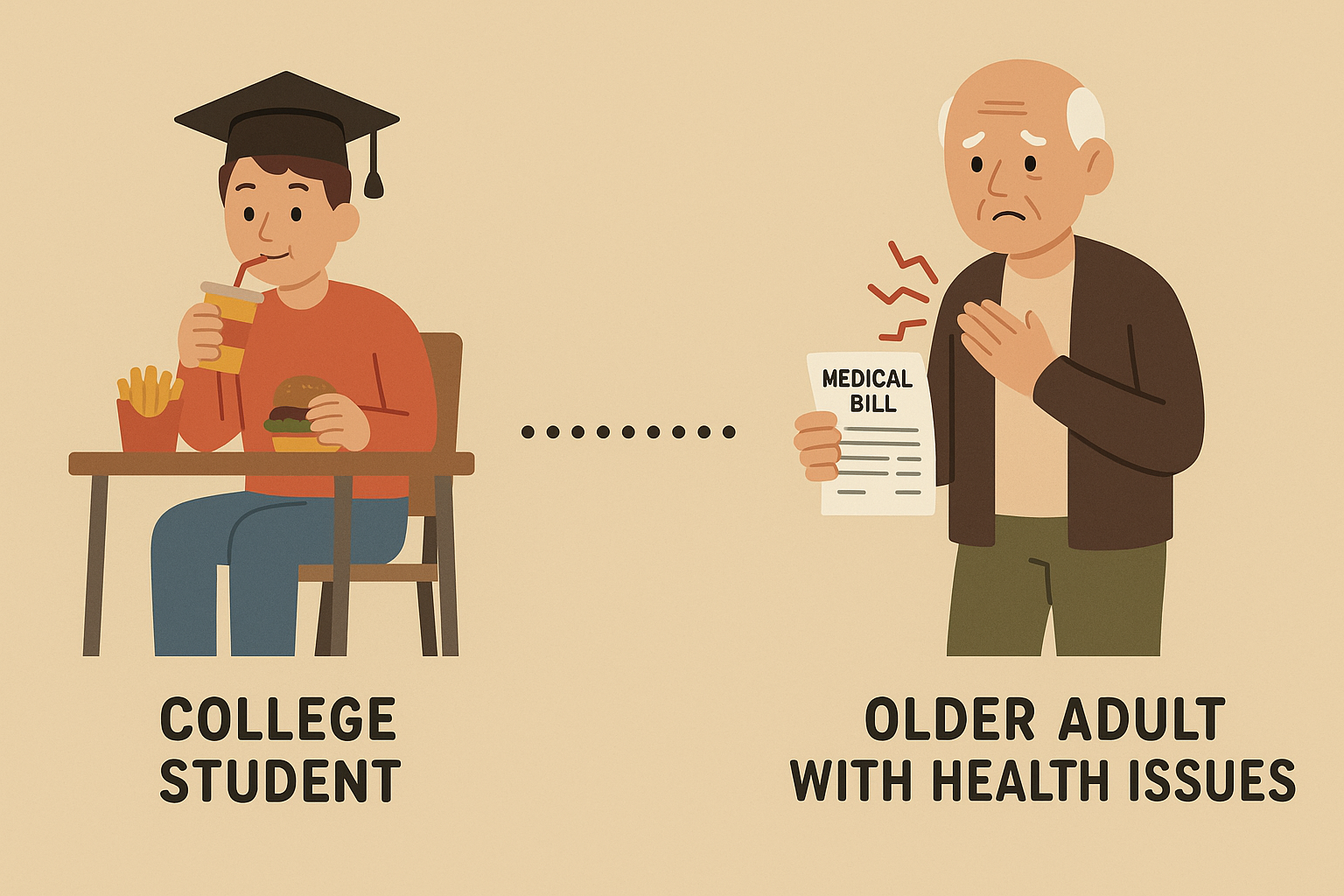

The Real Connection Between Food Choices and Your Future Health

This is where things get serious. The food choices you’re making with your meal plan aren’t just affecting your wallet – they’re setting up health patterns that’ll impact you for decades.

Campus dining prioritizes convenience and cost control over nutrition. That means you’re often choosing between what’s easy, what’s cheap, and what’s actually good for you. And most of the time, you can’t have all three.

Just as students learn to optimize their meal plan spending for better nutrition, understanding how proper supplementation can bridge nutritional gaps becomes crucial for long-term health. Many students discover that certain nutrients are difficult to obtain through campus dining alone, making targeted supplementation like B12 for energy and fatigue reduction an important consideration for maintaining optimal health during demanding academic years.

Why Cheap Campus Food Costs More Later

Those $3 breakfast burritos and $5 pizza slices might seem like deals now, but they’re loaded with processed ingredients, sodium, and preservatives that your body will pay for later. I’m talking about healthcare costs, energy crashes, and the long-term effects of eating convenience food for four years.

The Hidden Healthcare Bill in Your Meal Plan

I gained 15 pounds freshman year, and it wasn’t just from late-night pizza runs. The campus food was slowly killing my energy, my focus, and my motivation. I was constantly tired, getting sick more often, and relying on energy drinks just to stay awake in class.

When I started calculating the true cost – including the energy drinks, the doctor visits, the prescription medications for stress and anxiety – that “cheap” campus food was actually costing me way more than cooking my own meals would have.

Stress Eating Cycles That Drain Your Balance

Academic stress makes everything worse. You’re tired, overwhelmed, and the last thing you want to do is think about what to eat. So you grab whatever’s convenient and comforting, which usually means expensive processed food that makes you feel worse.

I tracked my emotional state before dining decisions for two weeks, and the patterns were pretty clear. Stressed about an exam? $15 comfort food. Anxious about money? Ironically, more expensive “treat yourself” meals. It was a cycle that drained both my meal plan and my energy.

Understanding the connection between stress and eating patterns becomes even more important when considering how chronic stress affects your body’s ability to absorb nutrients effectively. Students experiencing high academic stress may benefit from learning about how anxiety manifests in physical symptoms and developing comprehensive stress management strategies that address both mental and physical health.

Food Security Issues Hidden in Plain Sight

Here’s something that’ll surprise you: you can have a meal plan and still experience food insecurity. It happens when your balance runs low, when you have dietary restrictions that campus dining doesn’t accommodate well, or when social anxiety makes dining halls feel inaccessible.

When Having a Meal Plan Doesn’t Mean Food Security

I knew students who had meal plans but were still going hungry because they couldn’t afford the campus prices with their limited balances, or because their dietary needs weren’t met by available options.

Food insecurity among college students is way more common than people think. According to “Mustang News”, a 2022 Cal Poly Basic Needs Report found that students experience food insecurity at a rate of 39% — three times higher than the national average, and their Campus Dining survey revealed that 49% of respondents — nearly 1,800 students — said they skip meals if they don’t buy food on campus.

Food Security Self-Assessment Checklist:

- Can you afford three meals per day with your current meal plan?

- Do you ever skip meals due to insufficient funds?

- Are you able to access food during all hours you need it?

- Do dietary restrictions limit your campus dining options?

- Have you used campus food pantry services?

- Do you feel anxious about your meal plan balance running out?

- Are you able to eat nutritious foods, not just fill your stomach?

If you answered yes to any of the last three or no to any of the first three, you might be experiencing food insecurity even with a meal plan.

Why Your Meal Plan Balance Affects Your Social Life More Than You Think

Your meal plan balance serves as a form of social currency that influences peer relationships, dating dynamics, and campus social hierarchies in ways that extend far beyond simple food purchases. The amount you have available and how you choose to spend it sends signals about your financial status, generosity, and social priorities that affect how others perceive and interact with you.

I didn’t realize how much my dining spending affected my social relationships until I started tracking both my balance and my social interactions. The patterns were uncomfortable to acknowledge but impossible to ignore once I saw them clearly.

The Social Economics of Campus Dining

Meal plans create unique social dynamics where food becomes a medium for relationship building, status signaling, and group inclusion. Students navigate complex social expectations around treating friends, participating in group dining experiences, and using food as a way to build and maintain relationships within their campus community.

The SDSU dining environment becomes a social laboratory where financial decisions intersect with relationship dynamics in ways that prepare you for similar situations throughout your professional life.

Navigating Group Dining Dynamics

Group dining situations create pressure to match others’ spending levels, participate in expensive dining experiences, or treat friends to maintain social standing. These dynamics can quickly drain meal plan balances while creating uncomfortable social situations for students with different financial resources or spending philosophies.

I learned to suggest alternative social activities that didn’t revolve around meal plan spending and practiced being honest about my budget limitations. Setting boundaries around treating others helped preserve both my balance and my friendships.

Dating and Meal Plan Economics

Campus dating often involves meal plan-funded dining experiences, creating unique dynamics where your balance affects your romantic life. Students may feel pressure to pay for dates, choose expensive restaurants to impress, or worry about appearing cheap when suggesting more affordable options.

Developing confidence in suggesting creative, low-cost date alternatives helped me maintain relationships without draining my meal plan balance. Being upfront about budget considerations actually strengthened relationships by establishing honest communication patterns.

The complexity of SDSU’s meal plan system adds to social pressures, with university housing residents able to change their meal plans during three designated change weeks throughout the year, but there’s a $10 change fee and cancellations are not an option at any time once selected, creating additional financial stress that impacts social decisions.

Campus dining prices create additional social pressure when students realize the markup they’re paying compared to off-campus alternatives:

| Campus Dining Price Comparison | SDSU Campus | Off-Campus (Vons) | Markup Percentage |

|---|---|---|---|

| Cocoa Krispies Box | $7.79 | $6.49 | 20% |

| Celsius Drink (12 oz) | $3.99 | $2.99 | 33% |

| Yerba Mate | $3.99 | $3.49 | 14% |

| 20 oz Pepsi | $1.99 | $1.49 | 34% |

Social Dining Budget Template:

- Weekly meal plan allocation: $____

- Personal dining budget: $____

- Social/treating others budget: $____

- Emergency fund: $____

- Date night budget: $____

What Campus Dining Taught Me About Managing Money After Graduation

Here’s the plot twist: everything I learned trying to optimize my meal plan actually prepared me for real-world financial management better than any class I took.

The skills you develop figuring out your dining budget – tracking spending, comparing value, making trade-offs under constraints – these are exactly the skills you need for managing corporate expense accounts, making investment decisions, and handling your first real paycheck.

Career Skills Hidden in Your Dining Decisions

When I got my first job, I had to manage a $500 monthly client entertainment budget. Guess what? I applied the exact same framework I’d developed for my meal plan. I tracked cost-per-interaction, optimized for relationship value instead of just spending money, and kept detailed records.

My manager was impressed with my expense management and strategic thinking. I got promoted within eight months, partly because I understood how to handle money responsibly – skills I’d learned trying not to run out of meal plan funds.

The SDSU dining system forces you to make resource allocation decisions under constraints – exactly what you’ll face in corporate budgeting, project management, and strategic planning roles.

Expense Management Skills Employers Actually Want

The ability to track spending, optimize resources, and make strategic decisions within constraints – these are valuable professional skills that most new grads don’t have.

I started documenting my meal plan strategies like a portfolio project. When I interviewed for jobs, I could explain my approach to budgeting and resource optimization using concrete examples. It helped me stand out because most candidates couldn’t demonstrate these skills.

Business Relationship Building Through Food

Campus dining also taught me how food works in business relationships. Those group study sessions where I learned to navigate who pays for what? That’s exactly what happens in corporate team lunches and client dinners.

Understanding how to use meals strategically for relationship building became valuable in my career. I practiced “hosting” business meals with study groups using my meal plan, which prepared me for similar situations in professional settings.

Investment Thinking and Long-term Planning

Students who view meal plans as investments rather than just expenses develop analytical frameworks that transfer directly to stock market investing, real estate decisions, and retirement planning.

From Meal Plans to Investment Portfolios

The same principles apply: diversification (don’t spend everything at one location), risk assessment (is this expensive meal worth it?), and return optimization (am I getting good value for my money?).

I started applying investment analysis to my meal plan selection and practiced portfolio thinking with my dining choices. When I started investing real money later, I already had the analytical framework.

Just as students often struggle to see the connection between current meal plan choices and long-term health outcomes, many adults fail to understand how current lifestyle choices impact their future vitality and energy levels. This is where understanding NAD+ for sustained energy optimization becomes valuable – it helps bridge the gap between immediate choices and long-term wellness through accessible health optimization solutions.

After graduation, I applied my meal plan budgeting framework to my first corporate job’s expense account. I treated the monthly $500 client entertainment budget similarly to a meal plan, tracking cost-per-interaction, optimizing for relationship value rather than just spending, and maintaining detailed records. My manager was impressed with my expense management and strategic thinking, leading to a promotion within eight months.

Professional Skills Translation Checklist:

- Budget allocation and tracking

- Vendor comparison and evaluation

- Cost-benefit analysis

- Resource optimization under constraints

- Strategic relationship building through food

- Data-driven decision making

- Long-term planning and forecasting

The Hidden Politics of University Food Services

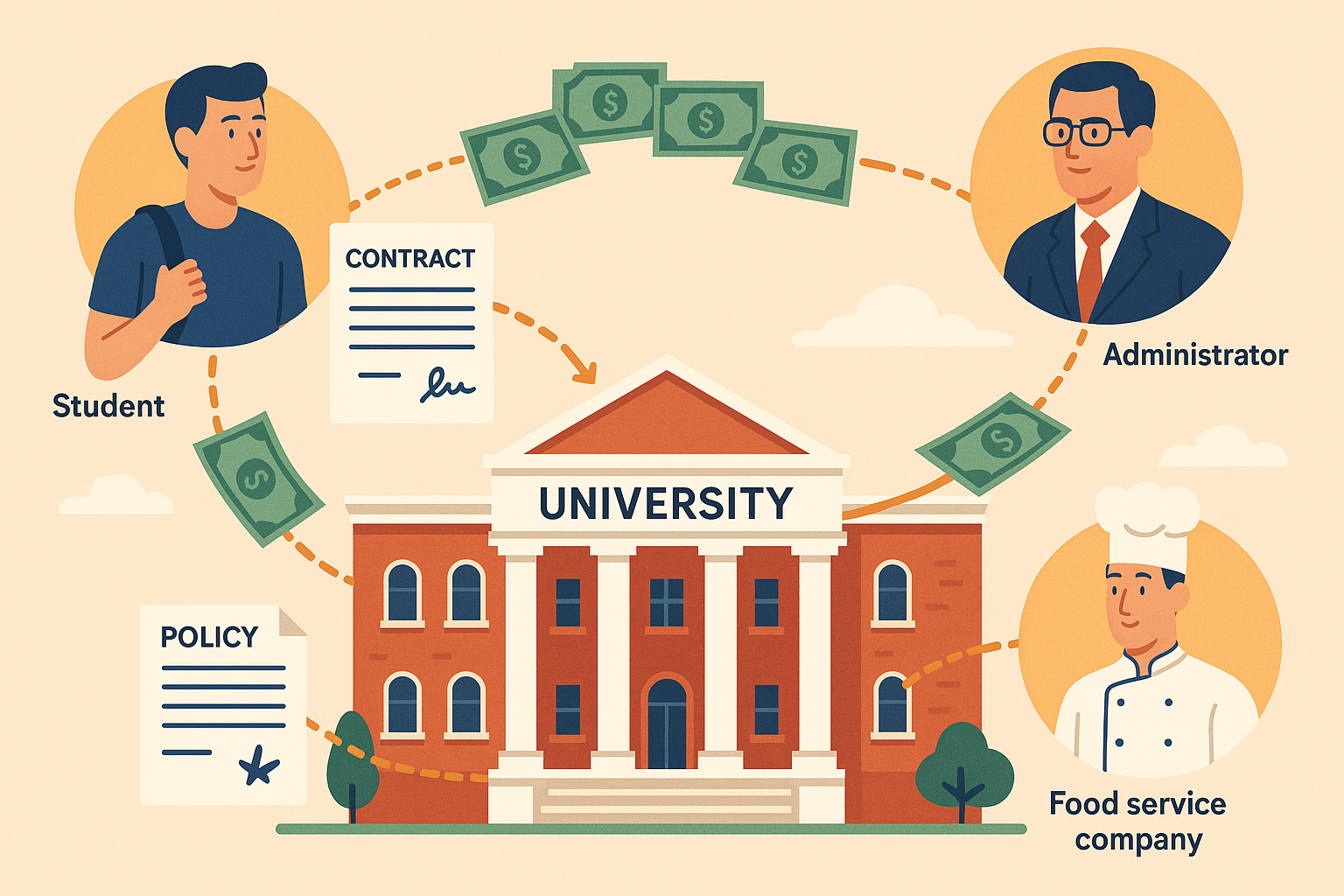

Okay, time for some real talk about how this whole system actually works. Your meal plan isn’t just about feeding students – it’s a complex financial machine that involves contracts, kickbacks, and competing interests that don’t always align with what’s best for you.

Understanding these dynamics helped me navigate the system better and even advocate for changes that benefited other students.

Revenue vs. Student Welfare

Universities have to balance making money from dining services with actually serving student needs. Guess which one usually wins?

Following the Money Trail

SDSU has contracts with dining service providers that create financial incentives that might not align with student interests. Understanding these relationships helps explain why certain policies exist and how they might be changed.

I spent time researching SDSU’s dining contracts, attending Associated Students meetings, and organizing student surveys about meal plan satisfaction. When you understand how the money flows, you can be more strategic about advocating for changes.

Where Your Meal Plan Money Really Goes

Here’s something that might surprise you: your meal plan money doesn’t just pay for food. It subsidizes other campus services, facilities maintenance, and administrative costs. You’re essentially paying more for food to support broader university operations.

I requested detailed breakdowns of how meal plan revenue is allocated and compared SDSU’s costs to similar universities. The actual “food cost” versus “subsidy cost” breakdown was eye-opening.

Student Advocacy and Change

The good news? Students actually have more power than they think. Universities depend on student satisfaction and retention, which gives organized student groups significant leverage in dining policy discussions.

Making Your Voice Count

Effective advocacy requires understanding the system, building coalitions, and presenting data-driven proposals that align with institutional interests while serving student needs.

I formed student committees focused on dining policy reform and developed proposals for meal plan improvements. We built coalitions with parents, alumni, and faculty who supported student interests, which amplified our advocacy efforts.

How to Turn Your Meal Plan Experience Into Career Skills

Here’s how to frame your meal plan management as actual career development:

Document everything: Keep track of your budgeting methodology, ROI calculations, and decision-making process. This becomes portfolio material for job interviews.

Practice analysis: Track vendor performance, analyze cost-benefit ratios, and develop personal financial systems. These are skills employers actively seek.

Lead initiatives: Coordinate group dining projects, present cost-benefit analyses to peers, and practice negotiation with dining services. Leadership experience is valuable regardless of the context.

Build frameworks: The analytical thinking you develop optimizing your meal plan transfers directly to professional financial management, project budgeting, and strategic planning.

Career Skills Development Framework:

- Document your budgeting methodology

- Track ROI on different dining strategies

- Analyze vendor performance and value

- Practice negotiation with dining services

- Lead group dining coordination projects

- Present cost-benefit analyses to peers

- Develop personal financial systems

Final Thoughts

Look, I know this might seem like I’m overthinking a simple meal plan. But here’s the thing – the habits you develop now around money, health, and social dynamics will stick with you for decades.

The student who learns to balance convenience with cost, social expectations with personal boundaries, and immediate gratification with long-term consequences is developing skills that’ll serve them well in everything from corporate expense management to investment decisions to health optimization choices.

Your SDSU meal plan balance might seem insignificant, but it’s actually one of your first real-world laboratories for understanding the complex relationships between money, health, social dynamics, and personal agency that define adult life.

Take the analytical skills you’re developing and apply them broadly. Whether you’re evaluating subscription services, making investment decisions, or optimizing your health, the frameworks you’re building now will compound in value over time.

And remember – every mistake you make with your meal plan is just practice for handling real adult money later. Trust me, it’s better to learn these lessons with dining dollars than with your first paycheck.

You’ve got this. And if you’re currently eating cereal for the third meal in a row because you blew through your balance, don’t worry – we’ve all been there. The important thing is that you’re learning.

The most successful students I’ve observed treat their meal plan like a training ground for real-world financial management. They understand that the patterns they develop now – whether it’s scarcity thinking or abundance mindset, impulsive spending or strategic planning – will follow them into their careers and beyond.

Whether you’re struggling with balance management right now, feeling overwhelmed by the social pressures around campus dining, or just trying to figure out how to make your money last until the end of the semester, remember that you’re not just learning about food – you’re developing life skills that most adults never master.

The connection between your current meal plan choices and your future success goes deeper than you might think. The same cost-benefit analysis skills you’re using to decide between the $8 sandwich and the $12 sushi will help you evaluate job offers, investment opportunities, and major life decisions.

The connection between your current meal plan choices and future wellness outcomes mirrors many adult health decisions. Just as you’re learning to balance convenience with cost in campus dining, you’ll face similar trade-offs throughout life when it comes to health optimization. Understanding how glutathione supports anti-aging and cellular health can help you make informed decisions about long-term wellness investments that go beyond basic nutrition.

As you transition from campus dining to post-graduation life, the same analytical approach you’ve developed for meal plan optimization can be applied to more sophisticated health decisions. Learning about advanced wellness strategies such as hormone replacement therapy costs and benefits represents the natural evolution of the cost-benefit analysis skills you’re developing now through campus dining management.

So next time you’re standing in line at the Student Union, calculating whether you can afford that expensive smoothie, remember that you’re not just making a food decision. You’re practicing the kind of strategic thinking that’ll help you navigate everything from corporate budgets to retirement planning.

Your meal plan might run out, but the skills you’re developing will last a lifetime. And honestly? That’s worth way more than any overpriced campus sandwich.